About

Limited Succession Options

While the benefits of engaging in a M&A are well-understood, many legacy companies struggle to pass the baton without worrying about everything they built being destroyed by the aggressive, quick flip mentality of many private equity firms. Not only that, but oftentimes children and extended family are hesitant to inherit their family’s operations in order to follow their own passions and forge their own paths.

All of these factors create a very risky and uncertain environment for family-run operations that don’t want to see their legacy crumble at the hands of short-sighted investment firms but also are in need of outside assistance to enable sustainable long-term growth.

This is where Metal Solutions Holdings comes in.

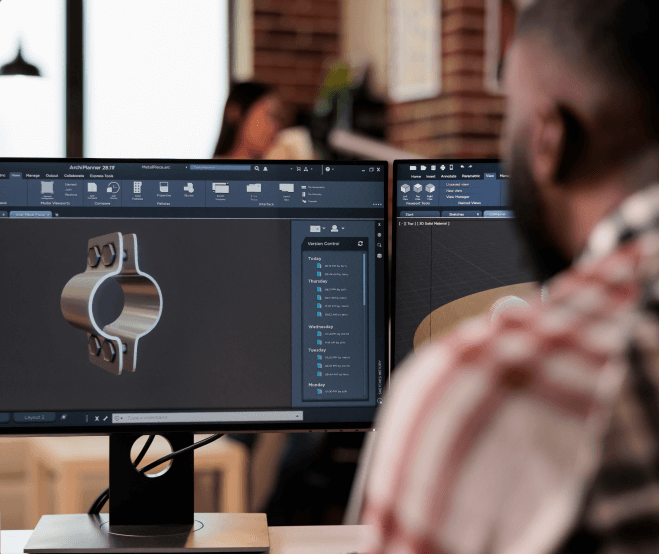

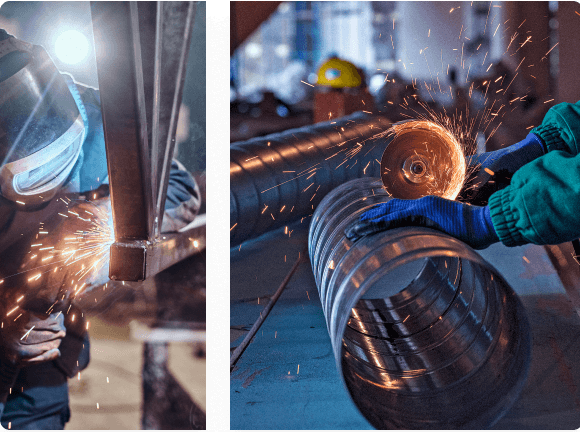

MSH leverages its founder, Jules, and his team’s background in engineering, manufacturing, and technology with outside capital to offer metal fabrication business owners a more trustworthy M&A option. Jules and his team strive to offer business owners in this industry a fair price for their businesses while giving them the peace of mind that they are selling to someone who will carry the torch and respect what has been built so far.

MSH deploys a unique financial model where instead of selling the business outright at the 5-to-7-year mark, we recapitalize the business again, pay a profit to equity shareholders, restructure debt, and repeat this process indefinitely. With this model, MSH shifts the focus from short-term manipulation to helping build sustainable legacies that the original owners would be proud of.